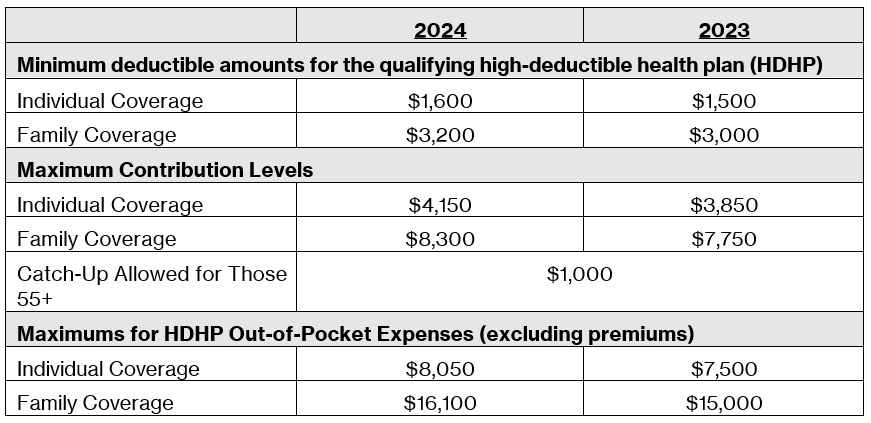

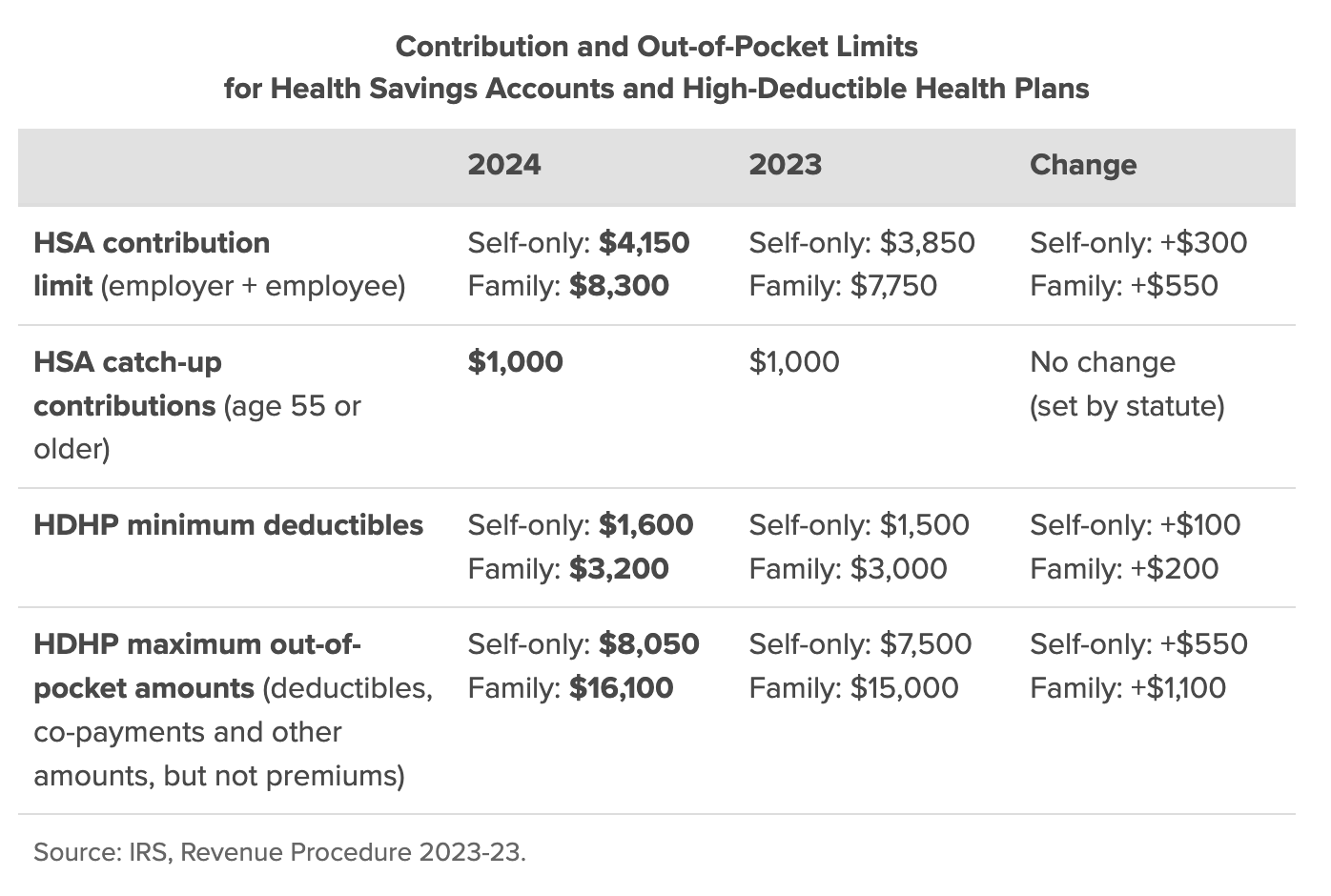

Fsa Amount For 2024 – The allowance, also known as FSA, is typically an extra monthly $250 that a service member is paid “to defray a reasonable amount of extra expenses” that come with a separation from their . $3,200 per plan for a healthcare FSA in 2024 ($3,050 in 2023). If both spouses have FSAs, each can contribute this amount. $5,000 total per family for dependent-care FSAs in 2023 and 2024 ($2,500 .

Fsa Amount For 2024

Source : www.k-state.eduIRS Announces 2024 Increases to FSA Contribution Limits | SEHP

Source : sehp.healthbenefitsprogram.ks.govS3 Ep 1: 2024 FSA Limits M3 Insurance

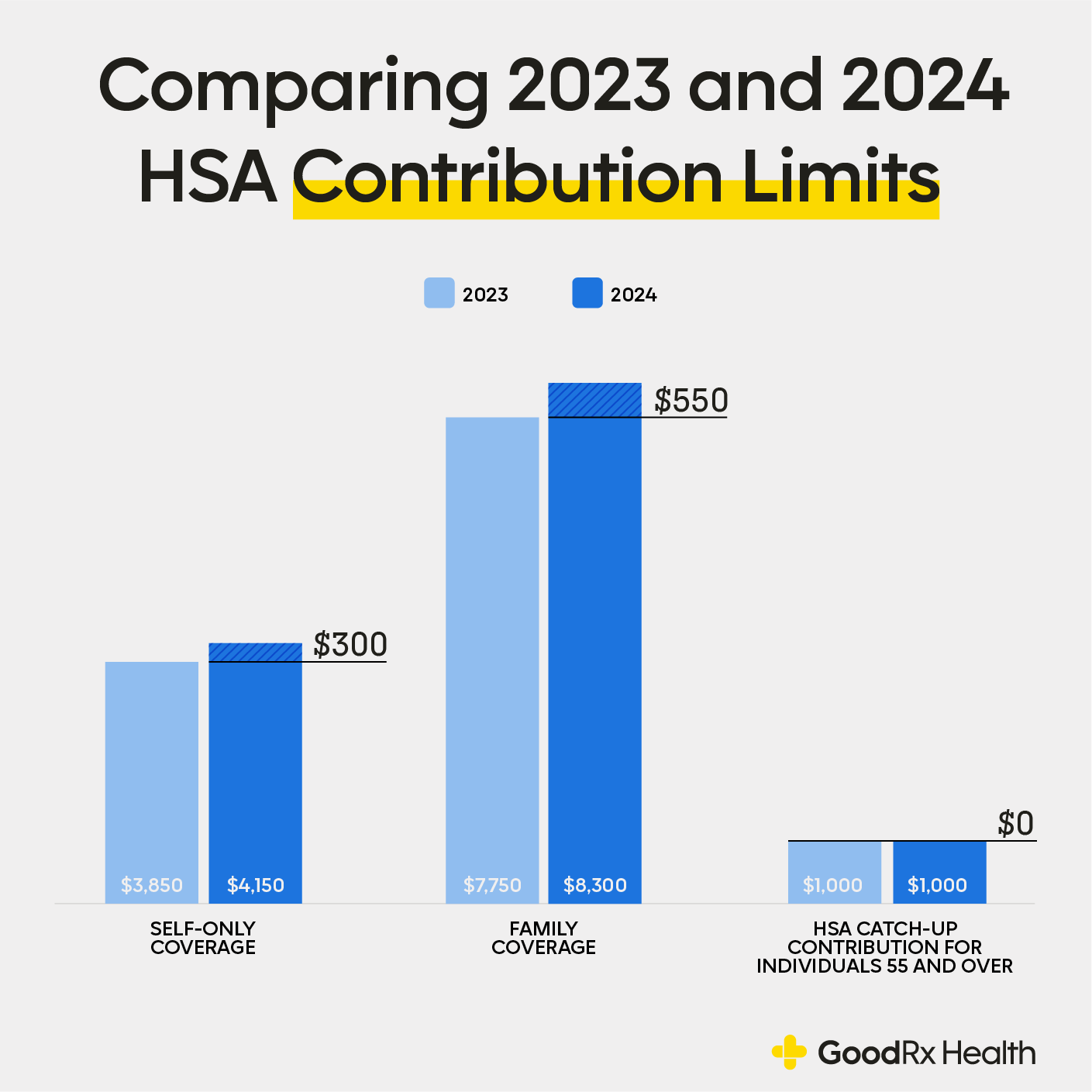

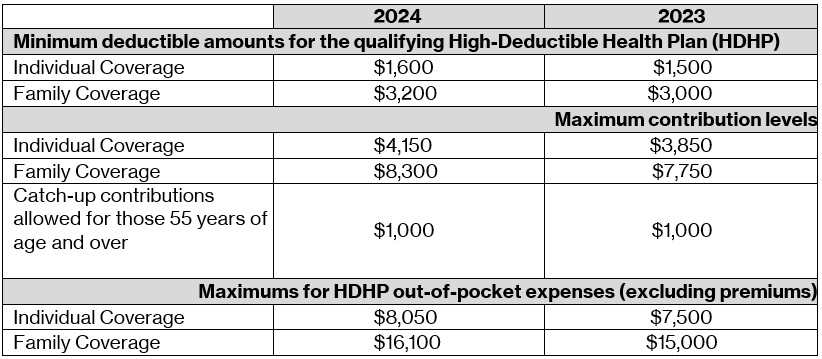

Source : m3ins.comThe HSA Contribution Limits for 2024: Here’s What Changing GoodRx

Source : www.goodrx.comUnderstanding the year end spending rules for your health account

Source : healthaccounts.bankofamerica.comIRS gives a big boost to many benefit contribution limits for 2024

Source : blog.healthequity.com2024 HSA Contribution Limits Claremont Insurance Services

Source : www.claremontcompanies.com2024 Health FSA Limit Increased to $3,200

Source : www.newfront.comIRS Makes Historical Increase to 2024 HSA Contribution Limits

Source : www.firstdollar.comPlan ahead in August of 2023 with updated 2024 HSA limits

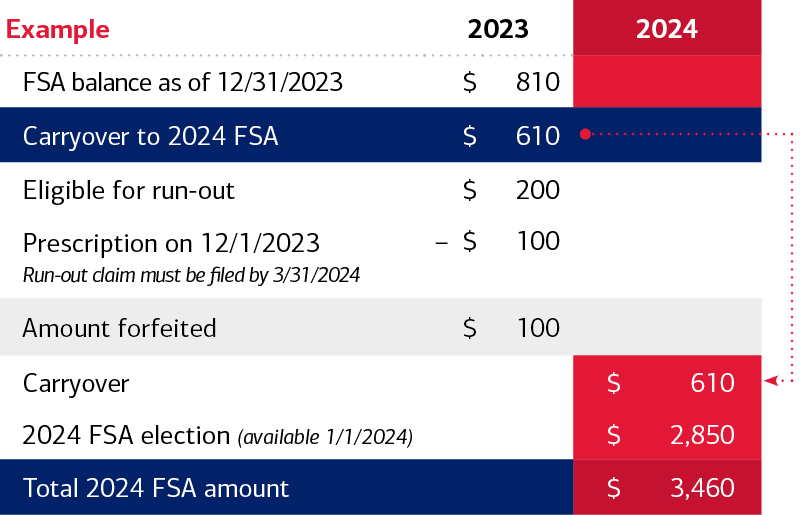

Source : blog.healthequity.comFsa Amount For 2024 2024 flexible spending account maximums have increased: The redesign of the 2024–2025 FAFSA form could make it more challenging for students and families to apply for financial aid. . If the employer’s plan permits the carryover of unused health FSA amounts, the maximum carryover amount rises to $610, up from $570. Spending spree: 10 useful things to buy with your FSA money .

]]>